Warning message

- Last import of users from Drupal Production environment ran more than 7 days ago. Import users by accessing /admin/config/live-importer/drupal-run

- Last import of nodes from Drupal Production environment ran more than 7 days ago. Import nodes by accessing /admin/config/live-importer/drupal-run

Unpublished Opinions

His 2018 Book "About Your Financial Murder..." is found on Lulu.com http://www.lulu.com/shop/http://www.lulu.com/shop/larry-elford/about-you...

Investment Misconduct and Malpractice Analyst

Larry Elford is acclaimed as a qualified expert on the subject of White Collar Crime as it relates to the investment selling industry. He is a retired CFP, (Chartered Financial Planner), a CIM, (Certified Investment Manager) by the Canadian Securities Institute, a FCSI, (Fellow of the Canadian Securities Institute), the highest designation awarded by the Canadian Securities Institute to those for top achievements in educational and industry accomplishments. He is also an Associate Portfolio Manager and Director of the Canadian Justice Review Board of Canada.

Larry worked inside the largest financial institutions in Canada for twenty years until his retirement in 2004. He works today writing, speaking and coaching Canadians on how to create safe and honest treatment for investors.

Larry Elford is also an author. He was included in John Lawrence Reynolds’ second edition bestselling book, The Naked Investor, Why Almost Everybody But You Gets Rich On Your RRSP and Bruce Livesey's 2012 book, Thieves of Bay Street, How Banks, Brokerages and the Wealthy Steal Billions from Canadians. He self-produced a documentary film, Breach of Trust, The Unique Violence of White Collar Crime, to benefit investors, legislators and those who investigate financial crime. It can be viewed on Youtube. https://youtu.be/k2K6pzFtyTU

Twitter: @RecoveredBroker

Facebook group for Fraud victims

https://www.facebook.com/groups/albertafraud/

Facebook group for Fraud victims across Canada (Small Investors Protection Association of Canada, 1998)

https://www.facebook.com/groups/240100382792373/

Video site for victims of investment malpractice

http://www.youtube.com/user/investoradvocate?feature=mhe

www.investoradvocates.ca research site

His first book is Titled "ABOUT YOUR FINANCIAL MURDER..." detailing the extent of financial abuse of the public attributable to a "self" regulated investment industry.

His second book, published in April of 2020, is "Farming Humans" and is about "How to quietly strip America bare of the truth "all men are created equal”, found in the U.S. Declaration of Independence, in less than 250 years….http://www.lulu.com/shop/larry-elford/farming-humans/paperback/product-2...

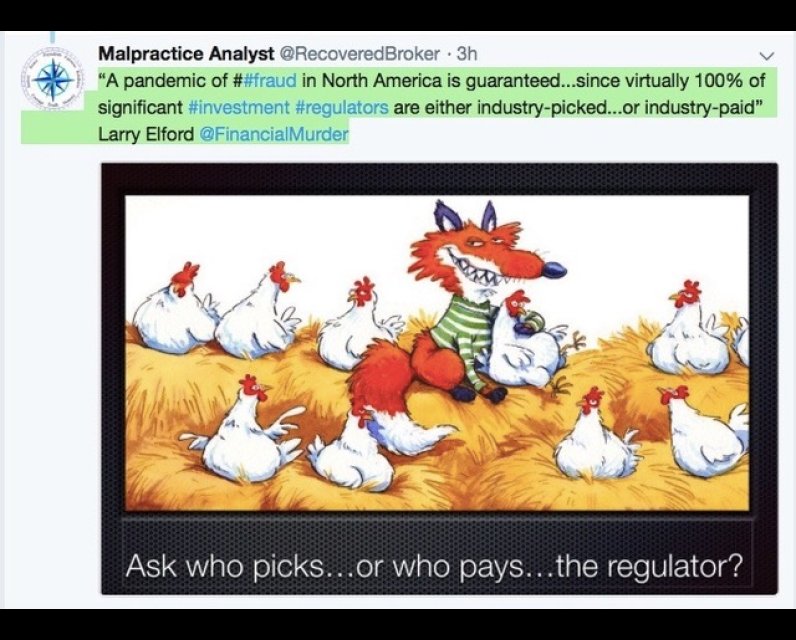

Financial Regulators Running A Side Business?

Todays Globe and Mail Nov 17, 2018, pointed out that senior executives at Bombardier who wished to sell their shares...secretly, without notifying the public as the law requires, were granted yet another exemption to our laws, which I feel the public should know of.

Most people feel we are protected by securities regulators in Canada and I would like to put forth the view that perhaps this is upside down, not true.

The $8 Billion in investment market value decline in BBD shares in the last month or so is roughly equal to about 1.5 million street crimes, at an average cost of $5000 per street crime. Most Canadians would be horrified to discover that 13 Canadian Provincial and Territorial Securities Commissions sell passes to "exempt" the laws, as easily as a high school kid sells fake concert tickets downtown. Most Canadians think securites commissions are protecting the playing field, not rigging the playing field. Most are wrong.

When exemptions were sold by Ontario Securitites Commission staffers to allow sale of unrated, illegal, Sub Prime Mortgage backed "investments", the harm to Canada was roughly equivalent to the cost/harm done by about six million street crimes (and Canada does not even HAVE six million street crimes....those are USA sized figures for street crime) The exemptions to securities laws allowed roughly $32 Billion of unlawful securities (Asset Backed Commercial Paper) to be dumped upon unsuspecting Canadians by dealers who wished not to be "stuck" holding the junk themselves.

When Valeant Pharma was given exemptions to Canada's laws, the end effect was 90 Billion in market cap removed from the value of this company and this was roughly equal to more street crime than one can even imagine. These organized schemes are done without public notice, without public input, and in near total secrecy. Not even the purchasers of law-exempted investment products have a right to be told. This is not regulation by any standard, but systemic financial abuse by financial professionals.

I would just like Canadians to be informed that orgainzed white collar crime is harming the land by more than all the crimes in the land....and that this is done by organized professionals, acting in secret.

Comments

Be the first to comment